|

GBP

Market sentiment surrounding GBP and the UK on a wider basis is sensibly poised for a breakout in either direction. Latest research from BMG indicated a narrowing between Labour and Conservatives, 33% and 39% respectively. YouGov’s latest poll concurs with BMG showing Labour on 34% and Conservatives on 43%. This broad based narrowing across all channels is expected to cap any rallies for GBP unless the gap widens again. On the other hand, if the gap continues to trend in Labour’s favour GBP in the run up to the election may fall from its 1.29 level to 1.27-1.28.

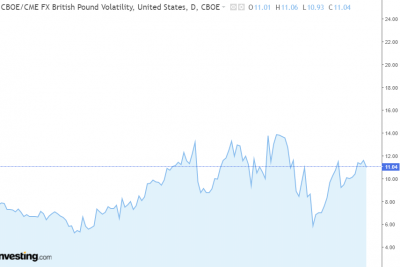

Volatility remains at just below

historically high levels which is unsurprising given the unprecedented economic and political environment that we have been thrust into. Monetary policy, fiscal spending, economic figures all remain inexorably bound to the withdrawal path the UK takes to leaving the EU. Historically GBP has always under-performed in uncertain market conditions and the last couple of years have demonstrated this perfectly. The only certainty we have is further uncertainty. Boris Johnson’s admission that the UK may still face a ‘No deal’ Brexit if a FTA (Free Trade Agreement) is not ratified remains a threat for GBP beyond December 12.

EURO

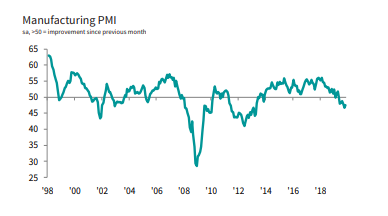

Key economic signals continue to underwhelm for the Eurozone as Spanish Manufacturing PMI contracted again during November at 47.5. Although this beat forecasts of 46.5 it remains below the pivotal 50 level, the barometer for contraction or expansion. Paul Smith, Economics Director at HIS Markit commented,

“Whilst the relative improvement in this month’s PMI raises hopes that the worst of the industrial downturn is passing, the sector remains a notable drag on the Spanish economy and is set to weigh on GDP figures for the fourth quarter. Companies widely reported facing goods markets characterised by client hesitancy and general uncertainty, the net impact being ongoing falls in demand, both from domestic and international sources.”

This uncertainty is not isolated to Spain as Germany is also in the midst of an Manufacturing recession which underscores the trading difficulty as globally growth has slowed and consumption has followed. Weakness of the Eurozone will lend a helping hand to GBPEUR which remains between 1.1650 – 1.1750. |