GBP

Last week for a brief moment economic figures took Centre Stage versus the normal political back and forth, as UK Manufacturing and Services PMI both fell into contraction territory; 48.3 & 48.6, the softer readings signalling that a fourth quarter UK contraction is possible. Although the readings provided the killer blow for GBP late last week it struggled to muster any real conviction to break higher, characterised by the ‘Triple Top Pattern’ that we alluded to last week, indicating that a drop may well be imminent.

The Tory manifesto has been released and interestingly there are no whirlwind promises, or slip ups for that matter, perhaps learning from the infamous “dementia tax” from Theresa May in 2017. This appears to have paid dividends as the lead over Labour remains healthy with polls reflecting an 12-19 point advantage. Providing this lead remains robust and notwithstanding any major economic shocks, GBPUSD should remain in its range of 1.26 – 1.29.

EURO

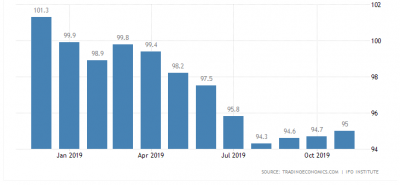

Germany, the powerhouse of the Eurozone economy has just released a slightly better IFO Business Climate reading, indicating that the manufacturing recession may have just started to ease. Economists outlook remain cautious as the strength of the domestic demand should allow Germany to see this low activity level through to 2020 but any further recessionary signals may weaken the Euro significantly from its already low 1.10 mark.

the ECB in particular will watch German activity levels very closely as a leading signal to move head of the markets to intervene if necessary with a more accommodative policy.

German IFO Business Climate Readings