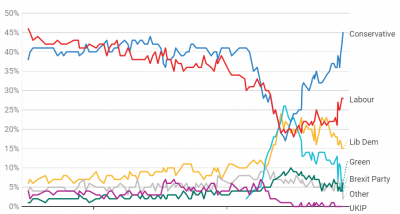

Across all major currency pairs GBP enjoyed a strong end to the week, the most notable being GBPUSD where it broke the descending trendline and 100ma, potentially pointing to some bullish sentiment for the coming week. As the technical picture took form, the fundamental one underpinned GBP strength as a poll released on Friday highlighted the growing Tory lead in the run up to the 12th December. As the polling gap between the parties continue to gyrate then we can expect GBP to trade accordingly, and should the deficit between Labour and Conservatives continue to favour the incumbent then GBP, theoretically should trade toward the 1.30 mark.

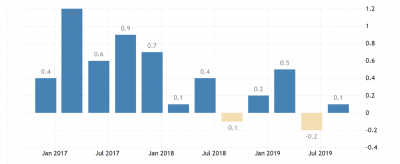

Short positions (selling interest) in the Euro remained at the highest level of all G10 currencies at the end of last week according to CFTC Commitments of traders. The aggregation of speculative positions against the Euro reinforces the broader weakness and lacklustre growth that the Bloc is currently suffering with. The powerhouse of Europe; Germany, narrowly avoided recession last week by posting a meagre 0.1% of growth in the third quarter, thereby avoiding the perilous two consecutive contractions. Ostensibly pursuance of, and achievement of growth is always a preferable outcome, however in Germany’s case this is not so simple. Hypothetically if Germany had slid into recession economists have commented this may have sparked a more accommodative easing cycle from the ECB to support growth and move to an inflationary goal. This may be difficult to justify now as although certain parts of the German economy are in a recession (manufacturing) the headline reading is just a little easier on the eye.